[ad_1]

Regardless of sustaining a dominant stance in a sensible contract and supporting the decentralized utility, Ethereum has gained a number of rivals eyeing for higher market place. The newest market worth of $154 billion stays a mountain to be breached by low-value tasks.

Crypto tasks are going through drastic challenges after the LUNA and FTX fiasco. Therefore, belief in a stabilized cryptocurrency reminiscent of ETH has simply strengthened. Ethereum is simply 110% in need of turning into the market chief above Bitcoin at its present worth. With the earlier uptrend heights reached by ETH, a optimistic breakout for the token surpassing others shouldn’t come as a shock.

Ethereum Worth Evaluation

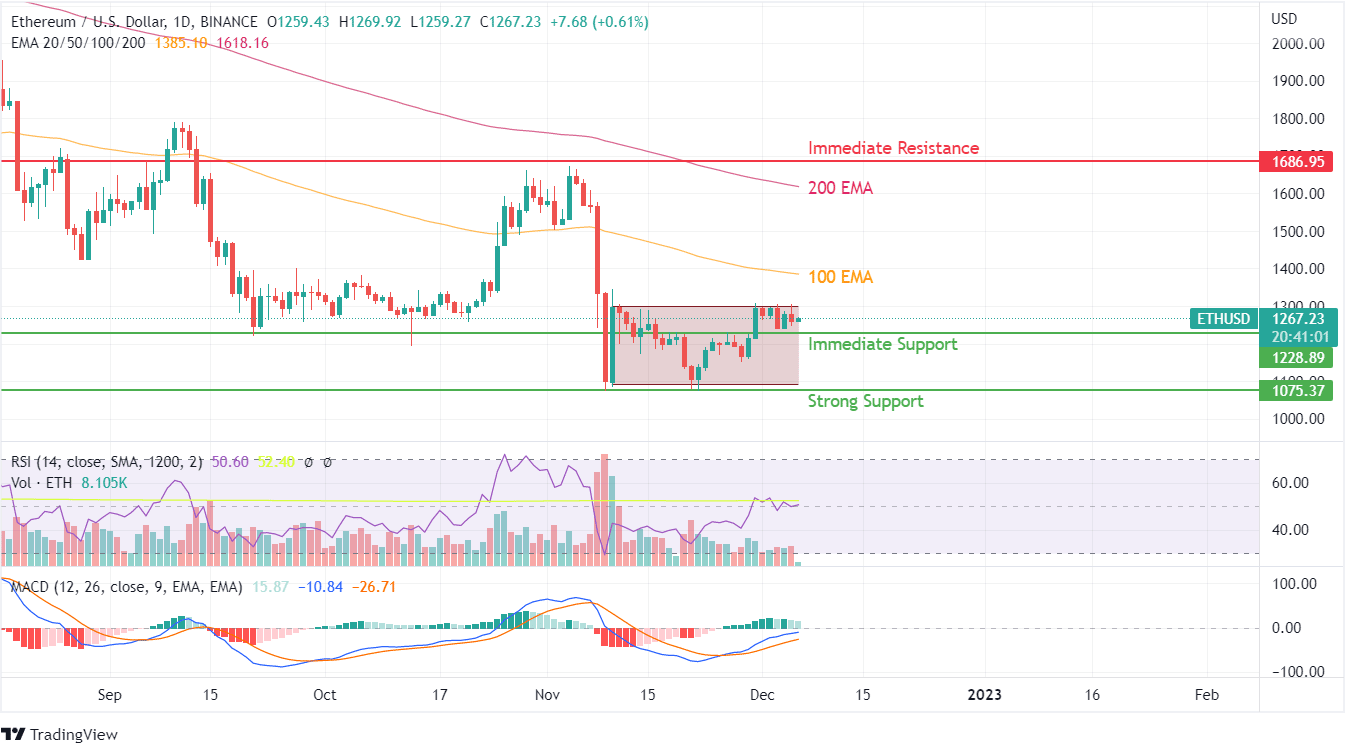

ETH has discovered help at $1075 as promoting exercise immediately halted at this stage. The worth momentum, nevertheless, has remained beneath a brief consolidation with the higher band of $1270 and a decrease band of $1075. The resistance of shifting averages has develop into a more durable problem for consumers.

Ethereum has maintained an in depth resemblance to Bitcoin’s worth motion and maintains an analogous worth motion. Nonetheless, the current decline in promoting actions as costs hit the decrease band of their earlier help stage of $1100 noticed optimistic shopping for motion from fans. Particularly for BTC and ETH, shopping for on dips has develop into one of the efficient methods for making income.

Holding for Ethereum noticed a decline throughout the preliminary part of its transition to proof of stake, and at present, the token is witnessing a shopping for spree. From the technical indicator RSI, the stature of optimistic sentiment may be confirmed, reaching 50 from 35 inside two weeks. The minor breakout sample has additionally managed the promoting sentiment and showcases an uptrending likelihood as ETH nears its shifting averages.

100 EMA curve for ETH trades at $1400 whereas the 200 EMA curve strikes at $1600. From a worth motion perspective, $1685 could be the hardest resistance stage on the short-term uptrend. MACD, throughout this optimistic motion, has jumped near the optimistic aspect with declining momentum. Patrons ought to technically await a breakout sample at 100 EMA to make a fast revenue or keep invested to reserving some revenue on the 100 EMA curve.

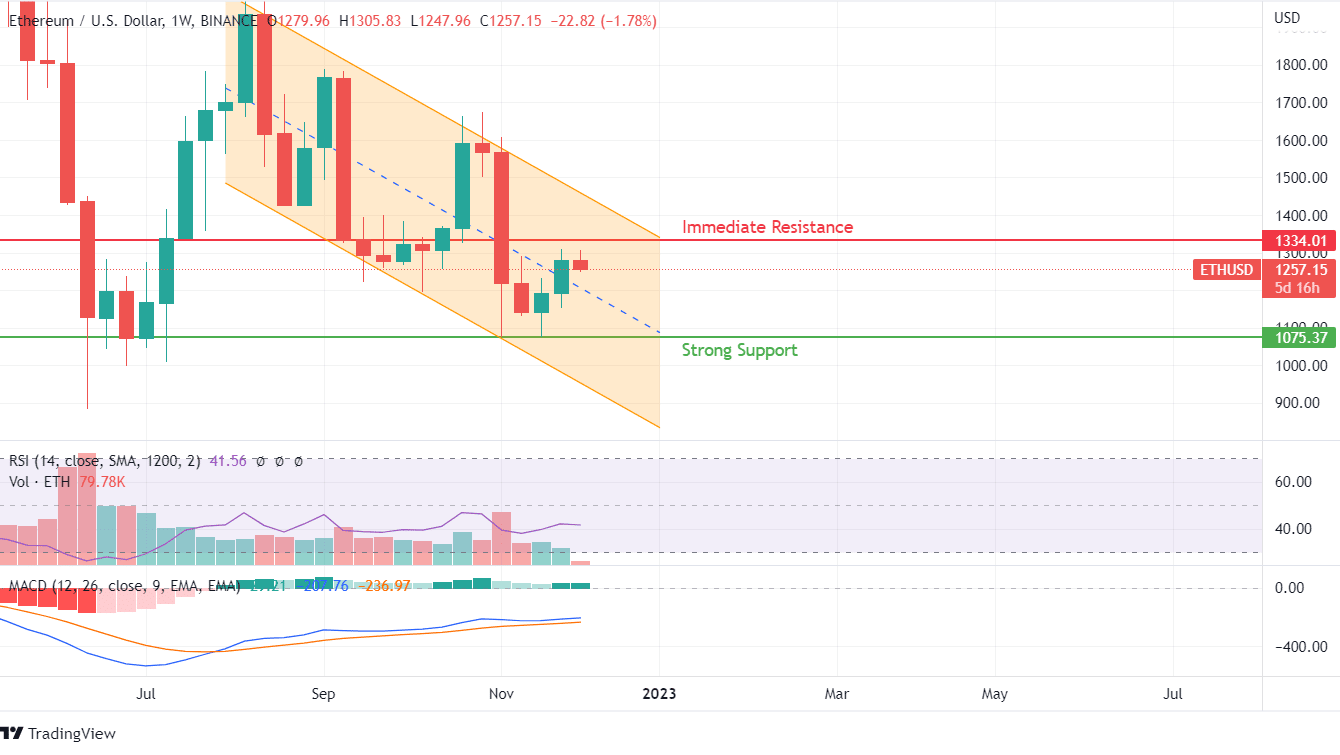

Ethereum is shifting in a draw back motion since hitting its peak of $2000 in August 2022. The resistance weighs heavier with every swing ensuing within the creation of a brand new help stage, which is very often short-lived. Present help of $1075 can create a downward spiral for ETH. Because the newest worth of ETH trades 18% above the help stage. Therefore, based mostly on our Ethereum worth predictions, the likelihood of a continued uptrend stays greater.

Technical indicators appear to be refraining from delivering any optimistic outlook, even within the longer-duration charts. Being the third consecutive optimistic weekly candle, ETH can have a more durable resistance on the $1335 stage. Therefore an absence of shopping for sprees may be seen right here.