[ad_1]

Ethereum managed to woo holders by showcasing a rising ecosystem after its shift to Proof of Stake, however in actuality, this step simply hindered the 100% decentralized ecosystem of ETH and made it extra controllable. With greater stakers underneath management, the worth and even hash price for ETH might be trampled.

Outlook for Ethereum might be ascertained from the demise of Solana in latest days, which confirms the powerful street forward from this level for ETH and comparable tokens meaning to make the most of the much less energy-consuming module of Proof of Stake. Regardless of the shortcomings and significant challenges, ETH stays the second largest cryptocurrency with an enormous margin of $143 billion which is 100 billion greater than Binance and 55% lesser than market chief BTC.

The uptrending days for ETH appears to be over as more difficult time has reached its door. Miners are already hoarding in the direction of higher blockchain rewards and transferring forward; it might get extra difficult.

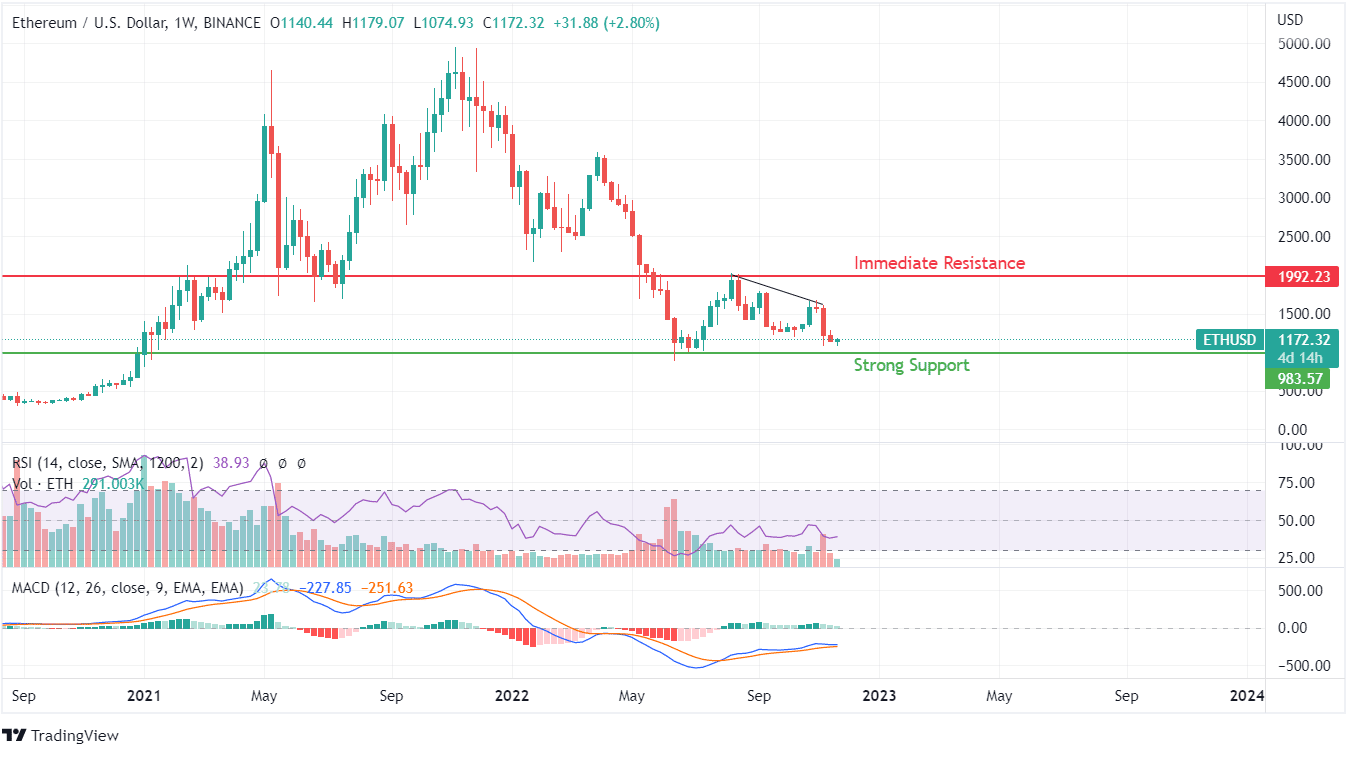

Ethereum has reached a low of $1172, which confirms the promoting stress on the prime. Reaching comparable lows in such a powerful promoting stance replicating the earlier rejection, we will count on the turnover to take fairly a while. Go to right here to know when will the Ethereum turnover occur!

Trying on the value motion, ETH carefully resembles LTC however fails to ship a strengthening ecosystem publish the merge for its Proof of Stake transition. Value motion exhibits Ethereum is going through resistance since hitting $2000 after the autumn in Could 2022, however the outlook hasn’t improved a lot. Whereas patrons took the dip enthusiastically, it didn’t have an effect on the uptrending prospects.

RSI has reached a impartial stance even on long-term charts, including to the promoting stress witnessed because the rejection on the prime. The MACD indicator has failed to succeed in a constructive stage on weekly charts because the crash in Could 2022, which provides extra stress for long-term buyers, protecting them away.

The assist of $2000 was first breached in June of 2021, adopted by Could 2022. The creation of $880 isn’t a assist stage however moderately a shopping for zone created out of the sheer uptrend prospects contemplating its peak of $5000.

Therefore, the phantasm of $880 being a assist stage needs to be saved apart earlier than coming into the ETH. Somewhat, if the costs tumble under $900 and make a bounce again, patrons ought to anticipate a affirmation earlier than making the next worth entry into the token.