[ad_1]

Lately, Litecoin accomplished its third halving occasion on August 2, 2023. This halving is critical for miners, slashing their rewards in half. The preliminary buzz was there, and Litecoin’s mining sector appeared to be on the rise, with promising progress. Nonetheless, as we glance nearer at Litecoin’s community stats, we begin to see a special story.

The primary crimson flag: a drop in community exercise. You’d count on the alternative with a halving. Curiously, after a spike on August 2, Litecoin’s hash fee started to say no. As of now, it’s hovering round 754.29 TH/s. Furthermore, the market has not been variety to Litecoin. Its worth took successful and has been on a downward pattern. We have to maintain a detailed eye on this bearish market habits.

In case you are an LTC fanatic, you may have one query in thoughts, “Will Litecoin go up?” On this submit, we are going to dive into the main points, dissect the explanations behind these tendencies, and discover the way forward for Litecoin (LTC) on this ever-evolving sector of cryptocurrencies.

Mining Metrics and Litecoin Future Development

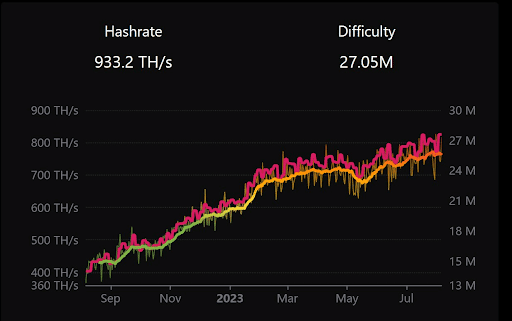

Litecoin boosted in a tweet not too long ago in regards to the outstanding progress in its mining sector. In line with the tweet, their mining problem reached an all-time excessive of 27.05M, and the hash fee steadily climbed towards its document.

These are undoubtedly constructive indicators, proper?

Effectively, maintain on a minute! A better evaluation of the mining metrics reveals a special story. A chart from Coinwarz tells us that LTC’s hash fee, after a notable spike on August 2, began to lower. As of now, Litecoin’s hash fee stands at 754.29 TH/s.

One other essential metric for miners, the miners’ charge, has been heading within the flawed route for weeks, as identified by Glassnode’s chart. Apart from that, Bitinfocharts information exhibits a major drop in Litecoin transactions over the previous few months.

Miners’ Metrics and Litecoin Community Exercise

First, allow us to inform you in regards to the hash rate- it measures how a lot computing energy is securing the community. We noticed a decline in a chart from Coinwarz. Furthermore, the miners’ charges have been down. After the final halving, it has turn into 6.25 LTC from 12.5 LTC, which could be discouraging for some miners. Apart from that, the variety of transactions on the Litecoin community has seen a major drop. It additionally appears to be a destructive signal for Litecoin’s future.

Value Decline & Affect on the Way forward for Litecoin

In line with CoinMarketCap, LTC’s worth has fallen by a major 11% up to now week. That’s fairly a drop!

Now, this decline can have some ripple results. When costs go down, it makes mining much less worthwhile for miners. With decrease earnings, some miners would possibly determine to modify off their mining rigs or transfer to mine different cryptocurrencies.

In such a case, it should impression the way forward for Litecoin and its hash fee. Nonetheless, based mostly on our Litecoin predictions, the LTC worth will commerce round $100 in 2023 and surpass $300 within the subsequent few years. Now, let’s talk about the technical elements.

Litecoin Technical Indicators and Pattern Evaluation

After the elemental dialogue, let’s dive into some essential technical elements and perceive the way forward for Litecoin:

First, we’ve got the Exponential Shifting Common (EMA) Ribbon. It exhibits a bearish crossover. The short-term shifting averages (50-Days EMA) crossed under the long-term shifting averages (100-Days EMA), indicating a possible downtrend.

Apart from that, CMF can also be taking place. It suggests that cash could be flowing out of the cryptocurrency.

Lastly, the Relative Power Index (RSI) is impartial, which signifies that the promoting strain is stronger than the shopping for strain.

Contemplating these indicators collectively, we predict LTC worth will probably be risky for the brief time period, and you may count on a downtrend within the subsequent few months.