[ad_1]

The Bitcoin Community Worth to Metcalfe (NVM) ratio has hit a excessive of 0.75 lately. Right here’s what this tells us in regards to the present BTC market.

Bitcoin NVM Ratio Has Been Using An Uptrend Just lately

As identified by an analyst in a CryptoQuant publish, the NVM ratio is at the moment at a 7-month peak. The “NVM ratio” is an on-chain indicator that measures the ratio between the log of the Bitcoin market cap and the sq. of the asset’s day by day energetic addresses.

The “day by day energetic addresses” here’s a metric that measures the whole quantity of distinctive BTC addresses which might be participating in some sort of transaction exercise on the blockchain every day. This indicator consists of each senders and receivers on this calculation.

The NVM ratio is predicated on Metcalfe’s regulation (therefore the “Metcalfe” in its full kind), in keeping with which the worth of any community is proportional to the sq. of the energetic customers. Within the case of the NVM, the energetic addresses metric performs the function of energetic customers.

When the worth of this ratio is excessive, it means the present worth of the asset is comparatively excessive in comparison with the energetic addresses, and therefore, BTC could also be overvalued proper now.

Alternatively, low values recommend there are a excessive variety of customers taking part on the blockchain, however the worth isn’t reflecting this in the mean time. Throughout this pattern, the asset could also be thought of undervalued.

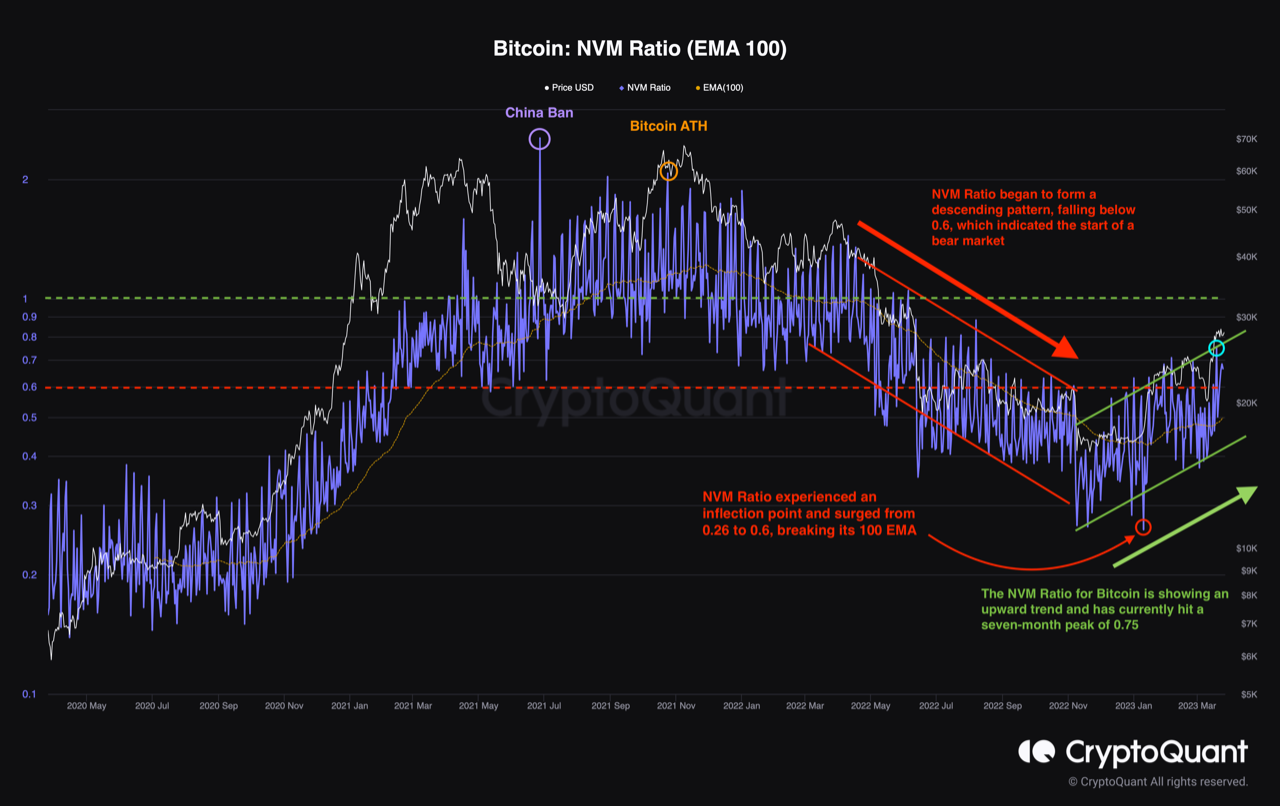

Now, here’s a chart that exhibits the pattern within the Bitcoin NVM ratio, in addition to its 100-day exponential transferring common (EMA), over the previous couple of years:

Seems like the worth of the metric has been on an general uptrend lately | Supply: CryptoQuant

As displayed within the above graph, the Bitcoin NVM ratio had been at values larger than 0.6 all year long 2021. Tops within the worth coincided with the indicator registering sharp spikes, with the present all-time excessive worth overlapping with the metric surpassing a price of two.

Apparently, a spike larger than even the aforementioned ATH was noticed in the course of the Could-July 2021 mini-bear interval. In line with the quant, this huge surge within the indicator came about due to the particular circumstances attributable to China’s mining ban.

In 2022, nonetheless, because the bear market arrived, the Bitcoin NVM ratio began to go down and breached under the 0.6 mark. Throughout this downtrend, the metric additionally dropped under its 100-day EMA.

However issues modified quick with the most recent rally within the worth, because the indicator shortly jumped from a low worth of 0.26 to 0.6. The uptrend within the ratio has continued together with the rally lately, and the metric has now hit a 7-month excessive of 0.75.

Whereas the metric could have damaged out of the undervalued zone of under 0.6, it doesn’t imply that the asset is now overvalued. From previous cases, it’s clear that the tops have taken place at far larger values than what the NVM ratio has displayed lately, suggesting that the rally could have some potential to go additional nonetheless.

BTC Value

On the time of writing, Bitcoin is buying and selling round $27,900, up 1% within the final week.

BTC has gone stale in latest days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com