[ad_1]

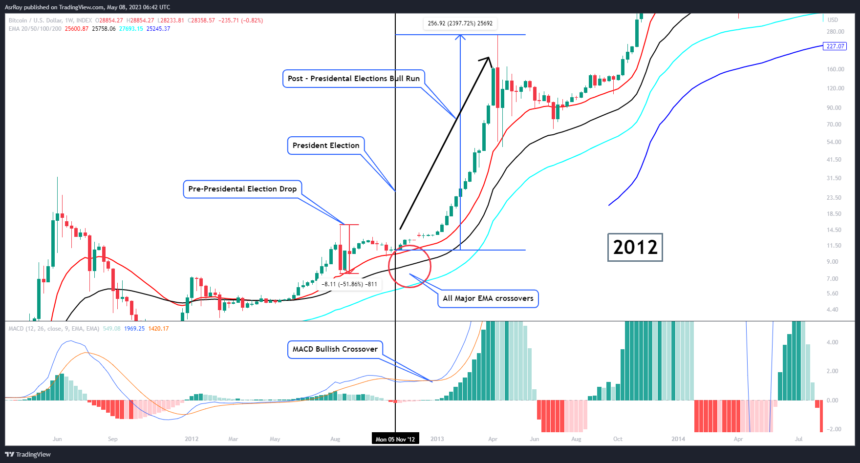

Bitcoin (BTC), the world’s first and largest cryptocurrency, has been related to a number of bull runs through the years. One of the crucial notable uptrends occurred in 2012, and monetary analyst and cryptocurrency skilled Aditya Siddhartha has linked it to the USA of America (USA) Presidential Elections.

Why Does The US Presidential Elections Matter For Bitcoin?

In response to Siddhartha, the 2012 Bull Run of Bitcoin was preceded by a big drop in BTC’s value, with a lower of 52% noticed available in the market. Nonetheless, after the transferring common convergence/divergence (MACD) Bullish Crossover and all main exponential transferring common (EMA) Bullish Crossovers, the market began to achieve momentum, and the bull run started.

Within the case of BTC’s 2012 bull market, the MACD and EMA indicators supplied optimistic indicators, resulting in elevated investor confidence and a surge in demand for Bitcoin. This resulted in a post-Presidential Elections bull run, with Bitcoin’s value rising by 11800%.

On the identical be aware, Siddhartha noticed that in 2016, BTC’s value skilled a drop of 41% within the run-up to the Presidential Elections. Nonetheless, after the MACD Bullish Crossover and all main EMA Bullish Crossovers, the market started to achieve momentum, and the uptrend began.

Following the Presidential Elections, Bitcoin’s value skilled a post-election bull run, with the value rising by a staggering 2800%. This surge in value was pushed by elevated demand from buyers and a rising consciousness of Bitcoin’s potential as a retailer of worth and digital asset.

In 2020, Bitcoin noticed a big drop of twenty-two% earlier than the presidential elections. This drop was largely as a result of uncertainty surrounding the result of the elections and the potential impression it may have on the economic system and the inventory market.

Nonetheless, in accordance with Siddhartha, following the Presidential Elections, Bitcoin’s value skilled a post-election bull pattern, with the value rising by 410%.

Moreover, Siddhartha has urged that the value of Bitcoin may see a big pump to $40,000 earlier than the Pre-Presidential Elections in 2024. Nonetheless, the analyst additionally anticipates a drop of 25%-30% within the run-up to the elections, just like earlier years.

As in earlier bull runs, Siddhartha predicts that the MACD Bullish Crossover and all main EMA Bullish Crossovers will present optimistic indicators, resulting in elevated investor confidence and demand for Bitcoin. Following the Presidential Elections, Siddhartha expects a post-election Bull Run, with the value of Bitcoin probably rising by 450%, leading to a value vary of $180,000-$200,000.

On the time of writing, BTC’s value has been on the decline since Saturday. It has misplaced its beforehand established vary between $28,500 and $29,600 and has as soon as once more did not breach the important thing stage of $30,000.

BTC’s Value Drops 4% In 24 Hours

On the time of writing, BTC’s value has been on the decline since Saturday, at the moment buying and selling at $27,7000. It has misplaced its beforehand established vary between $28,500 and $29,600 and has as soon as once more did not breach the important thing stage of $30,000.

This stage is essential because it serves as a psychological barrier for buyers and merchants. Presently, BTC is reporting a lack of 4% within the final 24 hours, however, will Bitcoin handle to cease the present pattern and try one other run to surpass the $30,000 stage?

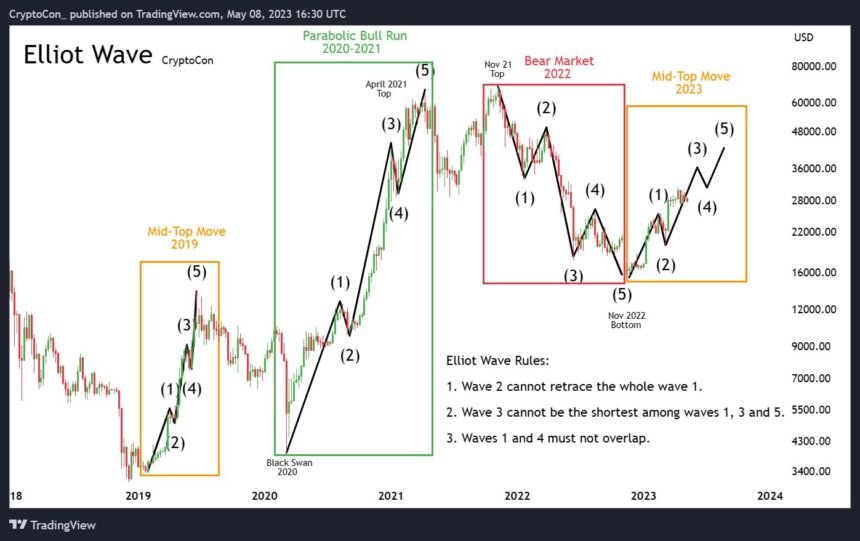

According to CryptoCon, Bitcoin has been following the Elliott Wave Principle fairly effectively and even used it to find out the underside in December 2022 at $16,500.

CryptoCon explains that, by definition, even wave 3 can’t be over as it might make it shorter than wave 1. Which means that there’s nonetheless room for Bitcoin to expertise important development sooner or later, regardless of any short-term corrections.

Featured picture from iStock, chart from TradingView.com