[ad_1]

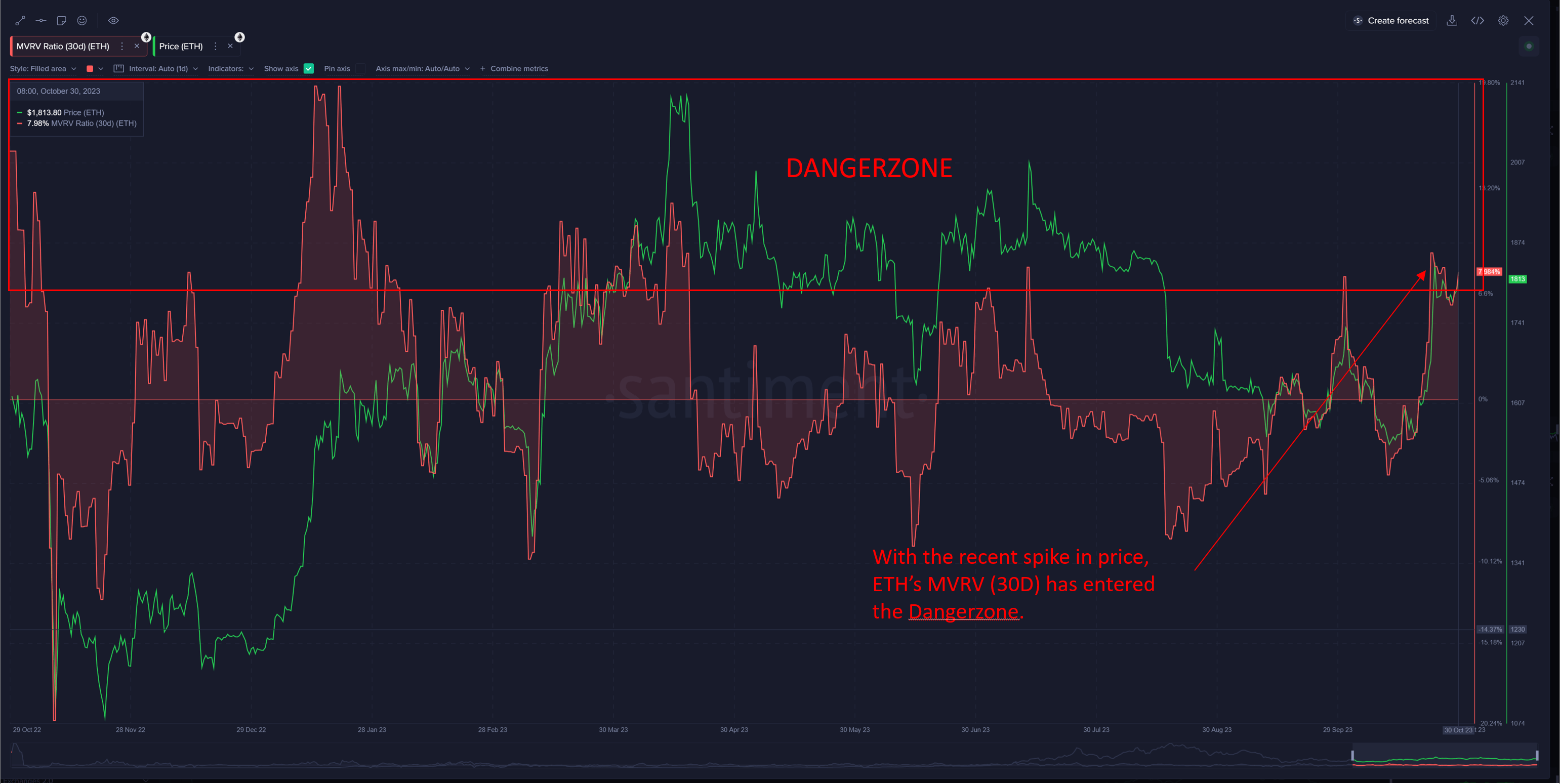

On-chain knowledge exhibits the Ethereum Market Worth to Realized Worth (MVRV) ratio has entered inside a hazard zone that has traditionally led to tops.

Ethereum MVRV Ratio Has Surged Into The Hazard Zone Not too long ago

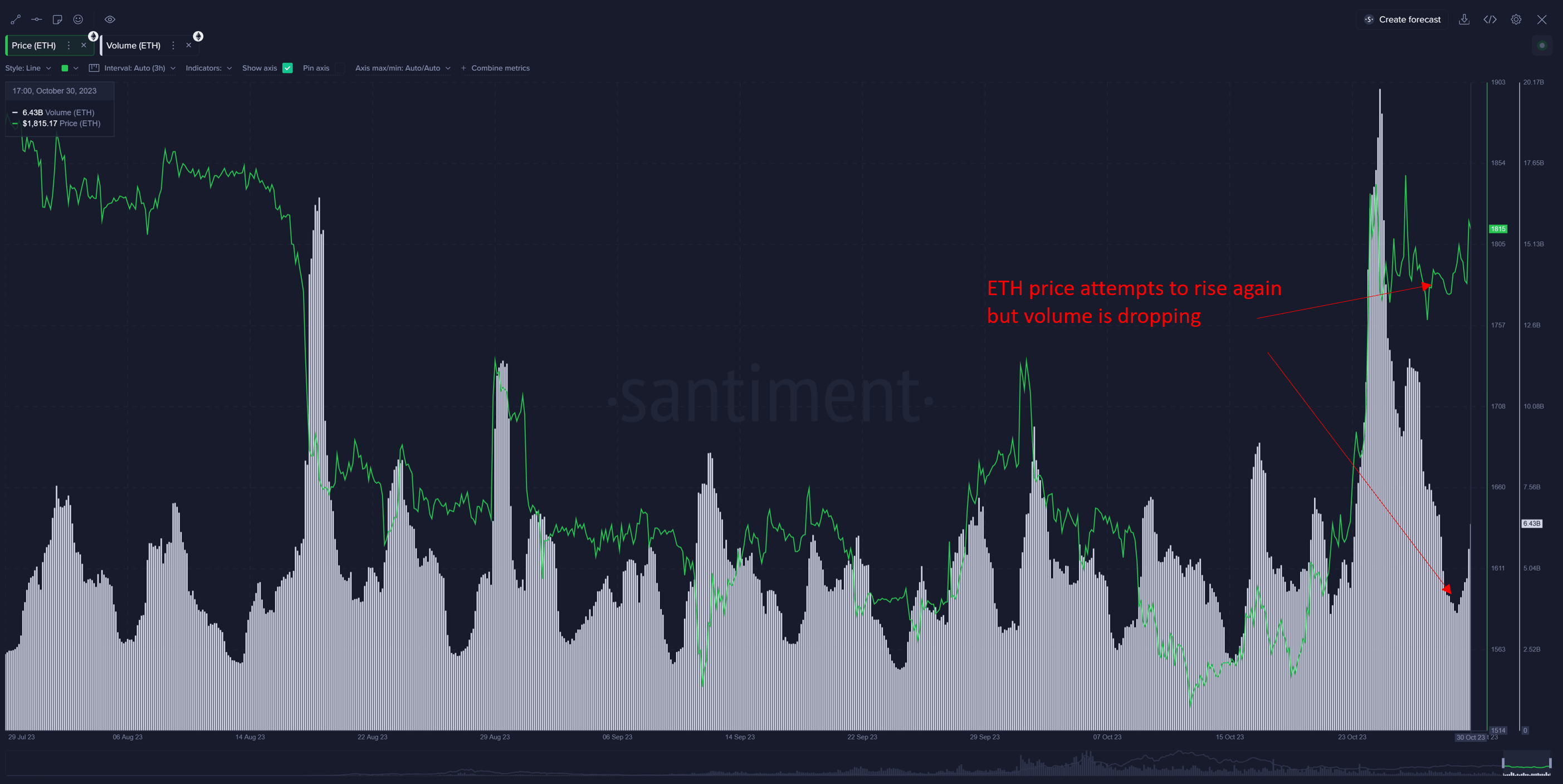

In its newest perception put up, the on-chain analytics agency Santiment has talked about some underlying metrics associated to ETH. First, the agency has identified how the buying and selling quantity of the cryptocurrency has gone down since Ethereum’s surge from just a few days again.

The worth of the metric has been sharply taking place just lately | Supply: Santiment

The buying and selling quantity observing a major decline whereas the value is attempting to proceed its rally might point out that momentum is weakening for the cryptocurrency.

One constructive for the asset, although, may very well be the truth that the availability on exchanges has gone down because the rally began, implying that the buyers have made internet withdrawals.

Seems to be just like the metric has plunged | Supply: Santiment

Usually, buyers switch their Ethereum out of those central entities to carry onto it in self-custodial wallets for prolonged durations, so this decline within the provide on exchanges may very well be an indication of contemporary accumulation.

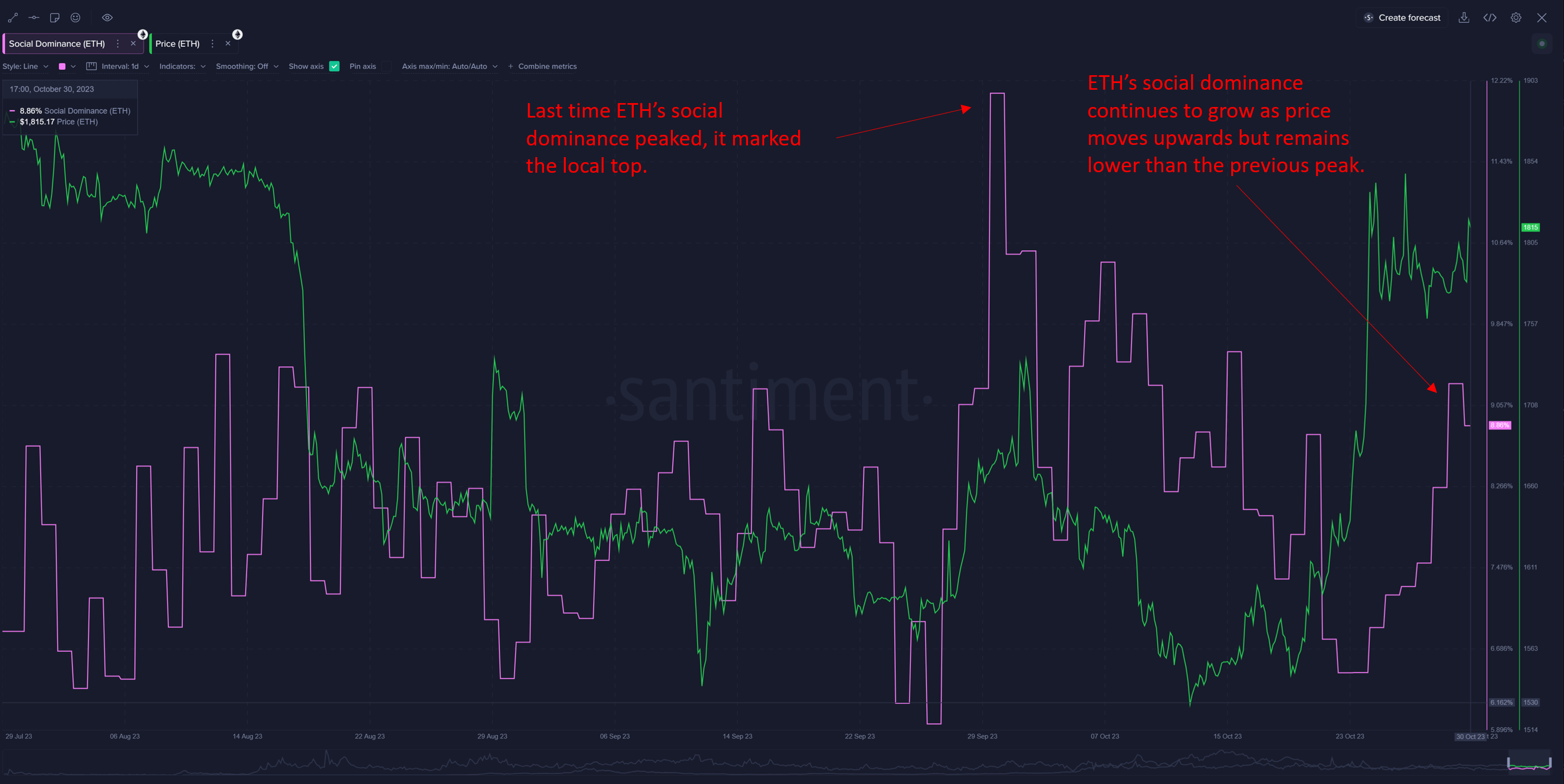

Following the most recent rise within the asset, its social dominance has additionally seen a leap. The “social dominance” right here refers back to the mindshare that Ethereum occupies on social media platforms among the many high 100 cryptocurrencies by market cap.

Curiosity round ETH has grown in the previous couple of days | Supply: Santiment

It will seem that extra eyes have been turning at Ethereum just lately, which is usually a signal that hype is build up among the many merchants. Traditionally, an excessive amount of hype has been detrimental for the asset, because it has typically led to high formations.

To date, although, the social dominance continues to be notably under the degrees it was at when ETH hit its native high at the beginning of this month, as is clear within the above chart. In accordance with Santiment, this “could counsel there will be some room for it to go earlier than issues settle down.”

A sign that’s extra concretely bearish for Ethereum, nevertheless, is the 30-day MVRV ratio. In easy phrases, what this ratio tells us is how the worth that buyers are holding (the market cap) compares towards the capital that they invested into the asset (the realized cap).

The indicator seems to have entered the hazard zone | Supply: Santiment

Right here, Santiment has used the 30-day MVRV ratio, which suggests this indicator solely retains monitor of the buyers/addresses who purchased their cash throughout the final 30 days.

As proven within the chart, this Ethereum indicator has just lately risen right into a territory that the analytics agency labels as a “hazard zone.” Traditionally, the value has seen a correction not too lengthy after the metric has reached this zone so one other native high could also be due for Ethereum proper now.

ETH Value

On the time of writing, Ethereum is buying and selling at round $1,800, up 1% prior to now week.

ETH has been caught in consolidation just lately | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.internet