[ad_1]

A quant has defined how the symptoms like taker purchase/promote ratio and Coinbase premium index can affect the worth of Ethereum.

Ethereum’s Relationship With Taker Purchase/Promote Ratio & Coinbase Premium Index

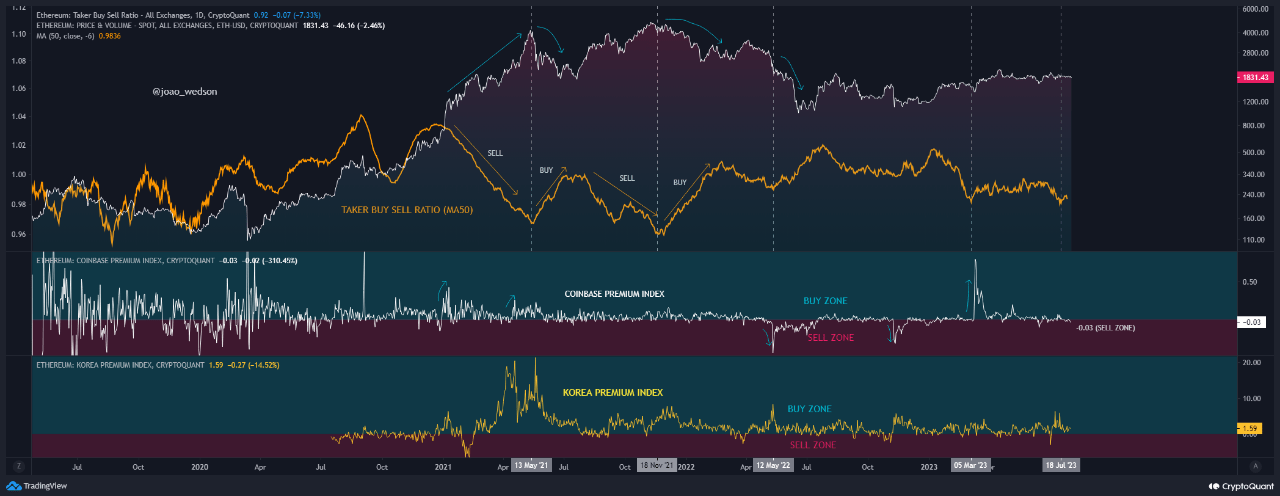

In a brand new CryptoQuant quicktake put up, an analyst has mentioned some metrics that might maintain relevance for the ETH worth. The primary indicator of curiosity right here is the “taker purchase/promote ratio,” which tells us concerning the ratio between the Ethereum purchase and promote orders available in the market proper now.

When this metric has a price higher than 1, it signifies that the taker purchase quantity is greater than the taker promote quantity. Such a pattern implies that almost all of the buyers are bullish on the asset presently.

Alternatively, values under the brink naturally suggest the dominance of bearish sentiment, as there are presently extra promote orders current on exchanges.

Now, here’s a chart that exhibits the pattern within the 50-day shifting common (MA) Ethereum taker purchase/promote ratio over the previous few years:

The potential relationship between these indicators and the worth of the cryptocurrency | Supply: CryptoQuant

As you possibly can see within the above graph, the quant has highlighted the sample that the Ethereum worth and the 50-day MA taker purchase/promote ratio have presumably adopted in the course of the previous couple of years.

It might seem that at any time when the worth of the asset has rallied, the taker purchase/promote ratio has gone down. This is able to counsel that the promote orders in the marketplace pile up because the ETH worth tendencies up.

The analyst notes that that is naturally as a result of the buyers grow to be extra cautious as the worth continues to rise since they assume a correction could also be coming quickly.

The promote orders proceed till the cryptocurrency has topped out, and as soon as the decline hits the asset, the purchase orders begin going up as an alternative.

From the chart, it’s seen that important accumulation durations have usually paved the way in which for the worth to backside out and start one other rally.

The quant has additionally hooked up knowledge for one more metric: the Coinbase Premium Index. This indicator retains monitor of the distinction within the Ethereum costs listed on Coinbase and Binance.

At any time when this metric has a optimistic worth, it signifies that the Coinbase platform has BTC listed at the next worth than Binance presently. This suggests that purchasing stress has been stronger from US-based buyers, who often use the previous alternate. Equally, unfavourable values suggest simply the alternative.

Based on the analyst, main fluctuations within the Ethereum worth have usually include sturdy adjustments within the Coinbase premium index, a doable signal that exercise on the alternate is the motive force for these worth strikes.

At the moment, the 50-day MA taker purchase/promote ratio is at comparatively low values and is trying to flip round, though this pattern shift in the direction of purchase order dominance isn’t confirmed simply but.

The Coinbase Premium Index is at impartial values, implying that there hasn’t been any buying and selling exercise occurring on the platform that’s completely different from Binance. Given these tendencies, it’s doable that Ethereum might not see any massive strikes within the close to future.

ETH Worth

On the time of writing, Ethereum is buying and selling round $1,830, up 2% within the final week.

ETH has erased its positive factors from yesterday | Supply: ETHUSD on TradingView

Featured picture from DrawKit Illustrations on Unsplash.com, charts from TradingView.com, CryptoQuant.com