[ad_1]

Bitcoin is the most well-liked cryptocurrency with a variety of use circumstances. Many crypto fanatics regard it as a market chief as a result of rally proven in 2020-21. Because the starting of this 12 months, 2022, it has been in a downtrend, and nonetheless, it’s persevering with its unfavourable sentiment even in November.

On the time of penning this publish, BTC/USD is buying and selling round $16,200 and round 1.3% down within the final 24 hours. Many specialists counsel the information of protests in China attributable to COVID restrictions is a catalyst of this downtrend. Apart from that, crypto markets have been below promoting strain because of the FTX liquidity disaster, so all these unfavourable sentiments have began the second wave of outflow from the crypto world.

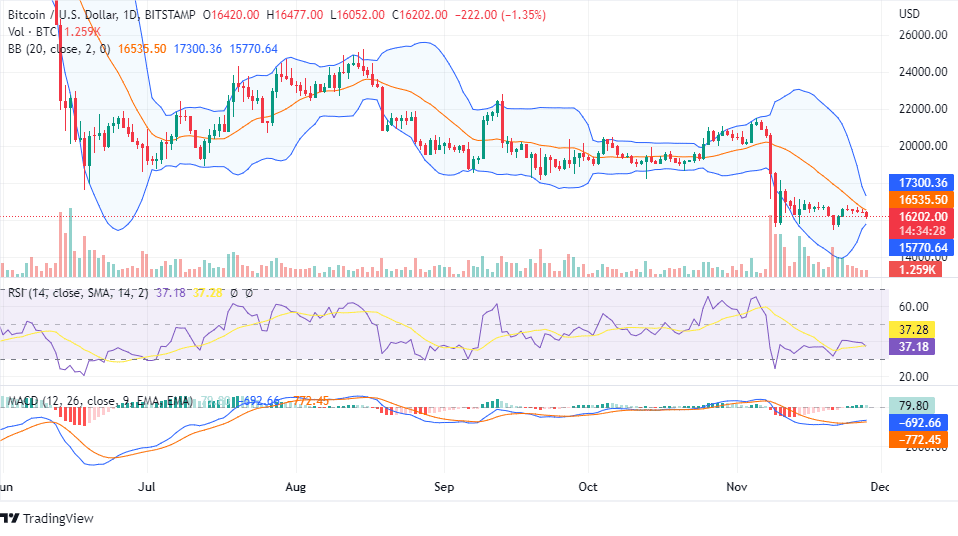

Within the brief time period, Bitcoin has been consolidating between $15,600 and $17,000. Candlesticks are forming within the decrease Bollinger Band, thus suggesting consolidation for the following few weeks. $16K is a vital degree of BTC; if it breaks this degree, it may be in a long-term downtrend, but when it sustains over this degree, it could consolidate or change the momentum after just a few months.

Most different technical indicators are impartial at the moment, and MACD generates inexperienced histograms with good quantity which will counsel a change in momentum for the brief time period. Nonetheless, we now have to research the long-term chart to get a greater view of the pattern.

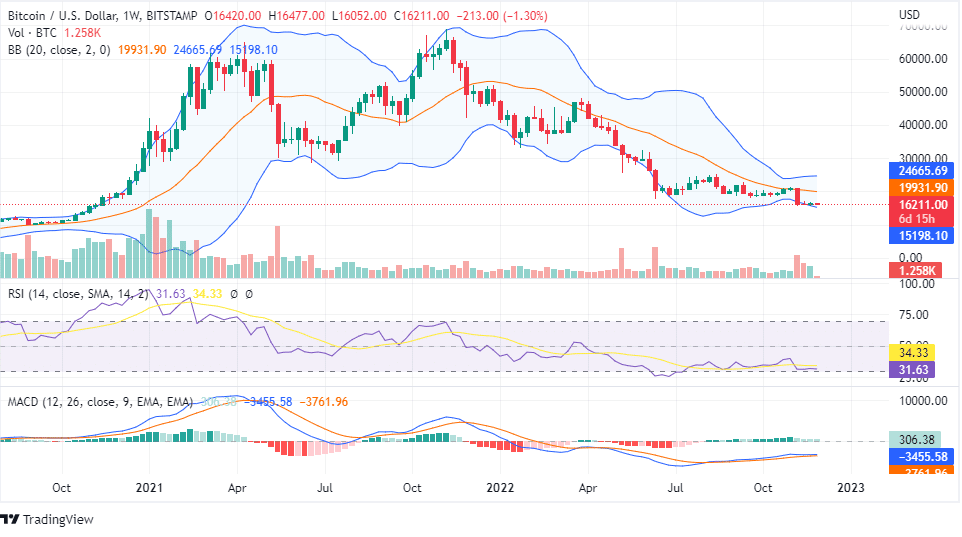

On the weekly chart, $18,000 was sturdy assist however the bearish engulfing candle on the primary week of November modified the momentum. Now it’s taking assist of round $16,000. If it breaks the extent, it’d come to the extent of $10k. We don’t assume it is a perfect time to build up extra cash when you’ve got invested across the $18K degree. In case your portfolio is within the unfavourable, it is best to maintain it for the following 5 years. Nonetheless, $10K will likely be a very good time to build up BTC and common the worth for the long run.

Certainly, crypto markets have been observing outflow within the final eight months after a bull run that implies it would consolidate even subsequent 12 months. It’s an accumulation part, and you shouldn’t count on a lot return from the crypto market. Certainly, it’s a dangerous funding for the long run, so it is best to make investments the quantity you’ll be able to afford to lose. Bitcoin is a much less dangerous digital asset which has the potential to interchange gold. Please comply with our web site to get the newest replace on Bitcoin.